On The Gamification of Investing - An afterword for Morgan Housel’s The Psychology of Money

When Robinhood broke ground almost 10 years ago as the first brokerage to offer zero-commission trades, doors opened for millions of aspiring investors across America. Now, customers could buy and sell as much as they wanted, without having to worry about paying expensive fees each time they did so. To stay competitive, other major brokerages quickly followed suit – in 2017 Fidelity Investments and Charles Schwab slashed equity commissions for the first time in a decade, and TD Ameritrade followed in their footsteps. By the end of 2019, they had all cut their commissions to zero.

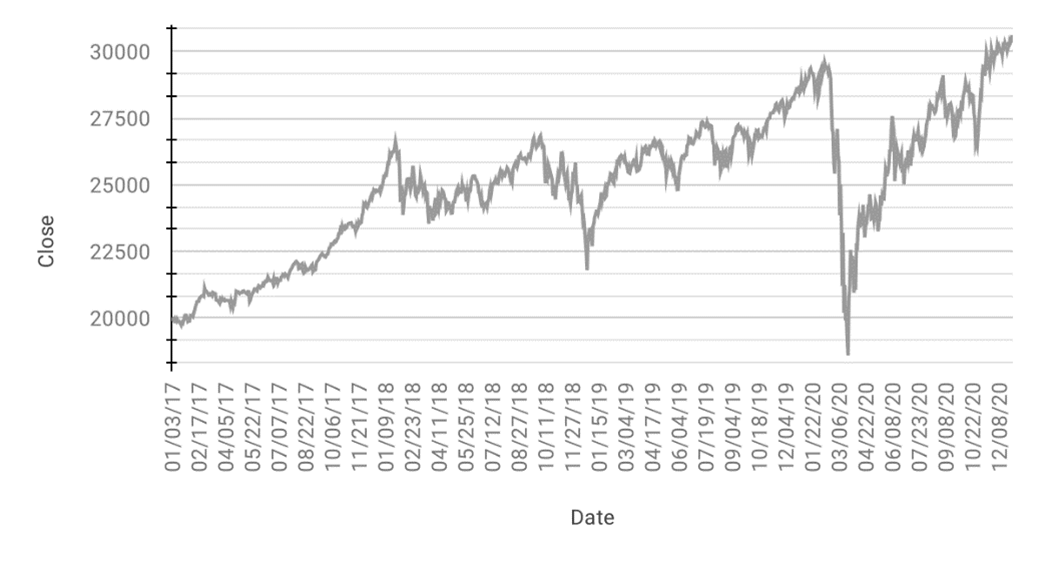

Just a few months later, the markets went through another major upheaval. As the COVID-19 outbreak reached full swing, the markets entered a panic, causing a massive selloff that resulted in a staggering 37% downturn. On March 16th, the Dow Jones (DJI) dropped 12.93%, the second-largest daily percentage loss in history, topping the crash of 1929 that marked the beginning of the Great Depression. March 12th and 9th also saw wipeouts of 9.99% and 7.79% respectively. Yet, thanks to the fast actions of the federal reserve, the markets quickly recovered, with the crisis “ending” on April 7th, and stocks correcting back to January levels by mid-November.

Yet, more shocking than the 37% downturn was the nearly twofold increase that the stock market saw between March 16th and November 1st. With a near-consistent increase in stock prices week over week, even the dumbest investor could turn a profit. The increased accessibility of investing, the ample free time and boredom afforded by remote work and school, and one of the most extreme bull markets seen in history combined to create the perfect casino – one in which the player always wins.

For many new investors, the stock market seemed like a foolproof way to make a quick buck. They believed that they could do no wrong, developing a certain level of complacency and a sense of invincibility. One of the most fundamental concepts of the stock market is its randomness – it is a field driven by uncertainty. Understanding this inherent level of unpredictability is fundamental to investing. A lack of fear and respect is one of the quickest ways to lose money.

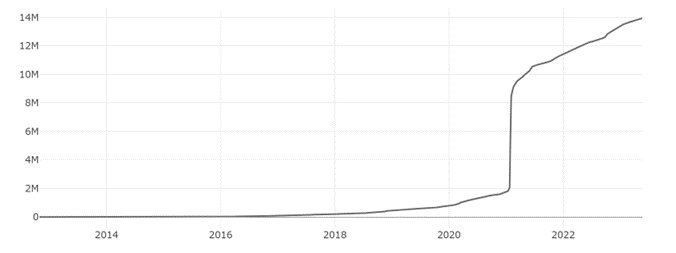

Events like the GameStop “short squeeze”, where individual investors drove the price of GameStop up almost 30-fold in one month, were evidence of a shift in mentality for many retail investors. The Reddit forum r/wallstreetbets, famous for its outlandish and extravagant betting on risky positions, saw its number of subscribers skyrocket throughout the GameStop saga as investors scurried to ride the momentum upwards.

Figure 2: Monthly Subscriber Growth for r/wallstreetbets, 2012 - present.

However, this behavior didn’t end there. Similar patterns can be seen with stocks like AMC, Nokia, BlackBerry, and Bed Bath and Beyond, which also saw artificial price explosions. Cryptocurrencies, which were a heavily unregulated market, and thus easy to manipulate, saw even more extreme swings. Take Dogecoin, which rose over 800% in 24 hours after a series of tweets from Elon Musk. Though patterns like this had been seen before in less controlled markets, it was relatively new to see this level of mass manipulation of companies with multi-billion-dollar market capitalizations.

Regardless of which instance you look at, the pattern is clear – recent years have seen a fundamental shift in retail investors’ attitude towards Wall Street, and thus how financial companies market towards them. Investing platforms like Robinhood capitalize on this gambling mentality, offering features like instant deposits, showering the screen in confetti each time an order is placed, or presenting the user with a free stock in the form of a scratch-off lottery ticket when they join the platform. Furthermore, Robinhood’s infamously easy-to-use interface allows users to one-click buy stocks and options, similarly to online shopping platforms, and, somewhat irresponsibly, places advanced investing features such as options trading and margin investing within reach of novice investors with little prior experience.

Brokerages, especially new-age ones like Robinhood, have learned the best tactics to rope new users in, such as gifting users free stock (usually more volatile ones) after they link their bank account or refer a friend. Furthermore, features like depositing rewards, where users receive free stock after depositing a certain amount into their account, collateral loans, where users can borrow money leveraged against their holdings, or giveaways, where users can win cryptocurrency after buying a certain amount, keep users hooked and entertained.

The pattern extends far beyond brokerages, however. Though seemingly more innocent, budget-tracking apps and personal finance services also gamify their interfaces, enticing users with the same colorful buttons and flashing icons that are used in casino slot machines. For example, TurboTax recently introduced a feature called “race mode” to their tax preparation software, which puts users on a timer to finish their taxes as quickly as possible.

On a broader level, we see this gamification in increasingly more facets of our everyday lives. Psychological studies have shown that our attention spans are decreasing because of social media usage and that it takes progressively more to attract and retain our attention. Yet, the damage caused by this in the financial sector is far more drastic. The consequences shift from time wasted to the undoing of decades of saving for college funds and retirement.

And it isn’t just financial companies’ fault either. Internet forums frequently feature multi-million-dollar gains or losses on their front pages. We have become desensitized to seeing such large amounts of money appear and disappear in front of our eyes and have lost track of the underlying meaning of the movement of the markets. For many, the stock market has changed from a vessel used to hold money in the long term in order to save for retirement to a legal online casino that can make you a millionaire overnight.

We know that humans are hardwired to enjoy gambling. Our dopamine levels spike when there is a level of uncertainty. We learn to enjoy the promise of a potential reward more than the actual reward itself. Gambling and economics are psychological fields more than anything else, and those who profit from them have learned to manipulate human nature to bend in their favor.

Throughout this book, we have seen how tightly intertwined money and psychology are. Wealth, especially at such large scales, is a concept that we have not evolved to understand. Sure, we might see that our neighbor has a bigger house or a fancier car than us, but we cannot possibly fathom the trillions of dollars that we see rising and falling each day. Principles like the compounding of money, the role of luck in success, the tradeoff of risk vs. reward, or the importance of leaving room for error and diversification are fundamental to building wealth, and a failure to understand and respect these concepts can result in financial ruin. We see the victors who played this game and escaped unscathed, but we rarely see the victims who didn’t know the concept of “enough”.

Throughout the short history of the stock market and the world of finance, there have always been people who lived on the edge and played this game. Yet in recent years, we have seen this number increase along with access to dangerous and risky investments, complacency towards risk and loss, and a nonchalant and apathetic attitude towards saving responsibly. The rate of admission to the casino is increasing, and more and more people who can’t afford financial failure are losing big. Companies continue to feed into this, incentivizing rather than discouraging this behavior, prioritizing profits over the well-being of their customers. Flashy interfaces, giveaways and rewards, and risky investing features like options trading or margin investing are the free drinks and comped hotel rooms of Wall Street’s casino.

Online communities, billionaire playboys, and social media “scamfluencers” collude together and employ viral growth to manipulate the markets and “stick it” to Wall Street and the hedge funds, but the victims are often new investors who get caught up in the craze and are left with nothing after the rug eventually gets pulled out from under them. The gamification of investing was inevitable. People see the opportunity to take advantage of human nature and make a profit from it, and gladly give them more tools and reasons to make riskier financial decisions. Yet the consequences of these decisions can be ruinous.

“Meme stocks”, shorting regional banks, or cryptocurrency scams may be the newest craze in the investing world, but they certainly aren’t the last. Safe and diversified investments almost always win out in the long run. If history has shown us anything, it’s that despite the actions of individuals, the markets continue unfazed on their unrelenting march forwards. It’s up to us to make sure that we don’t get trampled along the way.

Endnotes

Banerji, Gunjan. “‘I Came to Kill the Banks.’ Meme-Stock Traders Find a New Passion.” Wall Street Journal, 24 May 2023. www.wsj.com, https://www.wsj.com/articles/pacwest-bank-stocks-meme-stocks-6c042482.

Beilfuss, Lisa, and Alexander Osipovich. “The Race to Zero Commissions.” Wall Street Journal, 5 Oct. 2019. www.wsj.com, https://www.wsj.com/articles/the-race-to-zero-commissions-11570267802.

Costola, Michele, et al. “On the ‘Mementum’ of Meme Stocks.” Economics Letters, vol. 207, Oct. 2021, p. 110021. ScienceDirect, https://doi.org/10.1016/j.econlet.2021.110021.

Dow Jones Industrial Average (^DJI) Charts, Data & News - Yahoo Finance. https://finance.yahoo.com/quote/%5EDJI/. Accessed 23 May 2023.

Frazier, Liz. “The Coronavirus Crash Of 2020, And The Investing Lesson It Taught Us.” Forbes, https://www.forbes.com/sites/lizfrazierpeck/2021/02/11/the-coronavirus-crash-of-2020-and-the-investing-lesson-it-taught-us/. Accessed 27 May 2023.

“List of Largest Daily Changes in the Dow Jones Industrial Average.” Wikipedia, 26 Nov. 2022. Wikipedia, https://en.wikipedia.org/w/index.php?title=List_of_largest_daily_changes_in_the_Dow_Jones_Industrial_Average&oldid=1123896338.

Lyócsa, Štefan, et al. “YOLO Trading: Riding with the Herd during the GameStop Episode.” Finance Research Letters, vol. 46, May 2022, p. 102359. ScienceDirect, https://doi.org/10.1016/j.frl.2021.102359.

Mancini, Anna, et al. “Self-Induced Consensus of Reddit Users to Characterise the GameStop Short Squeeze.” Scientific Reports, vol. 12, no. 1, 1, Aug. 2022, p. 13780. www.nature.com, https://doi.org/10.1038/s41598-022-17925-2.

News, A. B. C. “How Reddit Users Sent GameStop Stock Soaring, Upending the Market.” ABC News, https://abcnews.go.com/Business/reddit-users-gamestop-stock-soaring-upending-market/story?id=75513249. Accessed 27 May 2023.

“‘Revenge Tactic:’ GameStop’s Massive Stock Surge Isn’t Only About Making Money.” Time, 28 Jan. 2021, https://time.com/5933931/gamestop-stock-market-reddit-money/.

R/Wallstreetbets Subreddit Stats (Wallstreetbets). https://subredditstats.com/r/wallstreetbets. Accessed 23 May 2023.

“Signs Of Gambling Addiction In Robinhood App.” Addiction Center, 2 Feb. 2021, https://www.addictioncenter.com/news/2021/02/gambling-addiction-robinhood-app/.

“Some Say Occupy Wall Street Did Nothing. It Changed Us More Than We Think.” Time, 15 Nov. 2021, https://time.com/6117696/occupy-wall-street-10-years-later/.

Staff, TheStreet. “What Was the COVID-19 Stock Market Crash of 2020? Causes & Effects.” TheStreet, 9 Nov. 2022, https://www.thestreet.com/dictionary/c/covid-19-stock-market-crash-of-2020.

The GameStop Episode: What Happened and What Does It Mean? | Cato Institute. 14 Oct. 2021, https://www.cato.org/cato-journal/fall-2021/gamestop-episode-what-happened-what-does-it-mean.

Thompson, Derek. “The Whole Messy, Ridiculous GameStop Saga in One Sentence.” The Atlantic, 28 Jan. 2021, https://www.theatlantic.com/ideas/archive/2021/01/why-everybody-obsessed-gamestop/617857/.

Wenk, Jason. How Does Commission Free Trading Work? https://grow.altruist.com/the-real-story-behind-commission-free-trading. Accessed 25 May 2023.

Zambonin, Bernard. “How GameStop Stock’s January 2021 Short Squeeze Changed the Markets.” Meme Stock Maven, 2 Feb. 2023, https://www.thestreet.com/memestocks/gme/how-gamestop-stocks-january-2021-short-squeeze-changed-the-markets.